Introduction

GST stands for “Goods and Services Tax”. In India, GST got implemented w.e.f. 1st July 2017.

The main objective behind introduction of GST is to consolidate multiple indirect tax levies into a single tax in order to overcome the limitations of existing indirect tax structure, and creating efficiencies in tax administration.

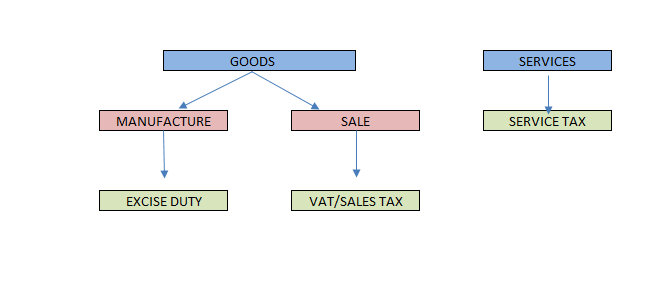

In order to understand GST, let us first understand how was the indirect tax structure in India before the introduction of GST.

Earlier Indirect Tax System in India

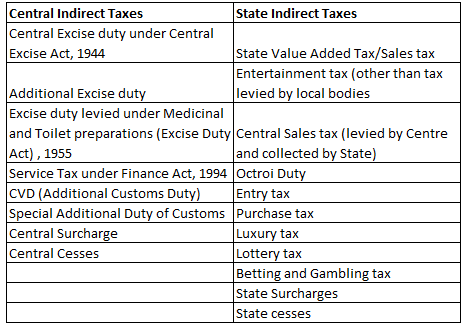

GST will subsume various Central and State taxes levied in old system which are tabulated below:

Due to these various taxes levied by Central and State Government, there was no uniformity of tax rates and structure across States and there was cascading effect i.e. ‘tax on tax’.

Advantages of GST

- Reduction in multiplicity of taxes

- GST eliminates the cascading effect of tax

- Higher threshold for registration

- Common system of classification of goods and services to ensure certainty in tax administration

- Composition scheme for small businesses

- Technology driven simple and easy online procedure

- The number of compliances reduced

- Defined treatment for E-commerce operators

- Improved efficiency of logistics

- Unorganized sector is regulated under GST

- Brings more transparency to indirect tax laws

- Boost the ‘Make in India’ initiative of the Government of India by making goods and services produced in India competitive in the National as well as International market.

Understanding GST

GST is the single tax on supply of goods and services, right from the manufacturer to the consumer. In the GST system, tax will be levied only on the value added at each stage.

Thus, the final consumer will bear only the GST charged by the last dealer in the supply chain with set-off benefits at all- the previous stages. It is a Destination based tax.

Components of GST

Before understanding the components of GST, let us first understand what is Intra-state and Inter-state supply

Intra-state supply- It means supply of goods and services within the state.

Eg- An electronic store in Maharashtra sells a mobile phone to a customer in Maharashtra itself.

Revenue will be shared equally between the Centre and the State, in case of Intra State supply.

Inter-state supply- It means supply of goods or services from one state to another. In GST, supply will be Inter- supply when the location of the supplier and the place of supply for the customer are in:

- Two different States; or

- Two different Union territories; or

- State and a Union territory.

Further, the supply of goods imported into India, till they cross the customs station is also classified as interstate supply. Also, supply of goods or services to or by a Special Economic Zone developer or a Special Economic Zone unit is classified as interstate supply.

Eg- A supplier in Maharashtra sells goods to a customer in Gujarat.

There are 3 components in GST as follows:

1.Central Goods and Service Tax (CGST) - It is a tax levied on Intra State supplies of both goods and services by the Central Government and will be governed by the CGST Act. SGST will also be levied on the same Intra State supply but will be governed by the State Government.

2.State Goods and Service Tax (SGST) - SGST is a tax levied on Intra State supplies of both goods and services by the State Government and will be governed by the SGST Act. CGST will also be levied on the same Intra State supply but will be governed by the Central Government.

3.Integrated Goods and Services Tax (IGST) - IGST is a tax levied on all Inter-State supplies of goods and/or services and will be governed by the IGST Act. IGST will be applicable on any supply of goods and/or services in both cases of import into India and export from India.

Eg- ABC enterprises of Maharashtra sold goods of Rs.200000 to a customer in Kerala and the applicable GST rate is 18%, then Rs.36000 IGST would be applicable. If the goods are sold by ABC enterprises to a customer in Maharashtra itself, then CGST of Rs.18000 and SGST of Rs.18000 would be applicable.

Mandate for Registration under GST

GST is applicable to businesses, professionals, freelancers and service providers. It does not apply to salaried individuals.

Registration is mandatory if you fall under any of the following cases:

1.Any supplier of goods and/or services who makes a taxable supply with an aggregate turnover exceeding Rs.20 lakhs in a financial year is required to obtain GST registration. In special category states, the aggregate turnover criteria is set at Rs.10 lakhs.

(Special category states are Assam, Nagaland, Jammu & Kashmir, Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Uttarakhand, Tripura, Himachal Pradesh and Sikkim).

2.Presently, anyone making inter-state taxable supplies, except inter-State job worker, is

compulsorily required to register, irrespective of turnover. It has now been decided to exempt those service providers whose annual aggregate turnover is less than Rs. 20 lacs (Rs. 10 lacs in special category states except J & K) from obtaining registration even if they are making inter-State taxable supplies of services. This measure is expected to significantly reduce the compliance cost of small service providers

3.Any person who sells online is required to obtain GST registration. He can sell through his website or through an operator like Flipkart or Amazon (i .e E-Commerce Operator or Person who supplies (except branded services) via an e-commerce operator).

4.Any person who sells goods on behalf of another taxable person (i.e. you are an agent) is required to obtain GST registration.

5.Any person who deal in goods/services on which reverse charge applies—where the buyer has to deposit tax instead of the seller. Please note that as per press release on 6th October 2017, The reverse charge mechanism under sub-section (4) of section 9 of the CGST Act, 2017 and under sub-section (4) of section 5 of the IGST Act, 2017 shall be suspended till 31.03.2018 and will be reviewed by a committee of experts. This will benefit small businesses and substantially reduce compliance costs.

6.Any person who supplies goods/services in a taxable territory and has no fixed place of business – referred to as casual taxable persons. Registration issued to such a person is valid for a period of 90 days.

7.Any person who supplies goods/services and has no fixed place of business in India – referred to as non-resident taxable person, is required to obtain GST registration. Registration issued to such a person is valid for a period of 90 days.

8.Distributors or input service distributors are required to obtain registration under GST. This person has the same PAN as the office of the supplier. This person is an officer of the supplier, he receives supplies and issues tax invoice to distribute credit of CGST/SGST/IGST.

Persons exempted from GST

1.GST does not apply to agriculturists. For example, if you grow your own flowers and sell them, then GST does not apply to you.

2.If you deal in exempted goods/services then GST does not apply to you.

3.If you do not fall under the above mentioned list of persons who are required to obtain GST registration.

Rates of GST in India

The government has categorised items in five major slabs - 0%, 5%, 12%, 18% and 28%.

Comments