From 1st July 2017, GST has replaced most of the Indirect taxes in India. There is slight difference between invoicing under GST and invoicing under the old regime.

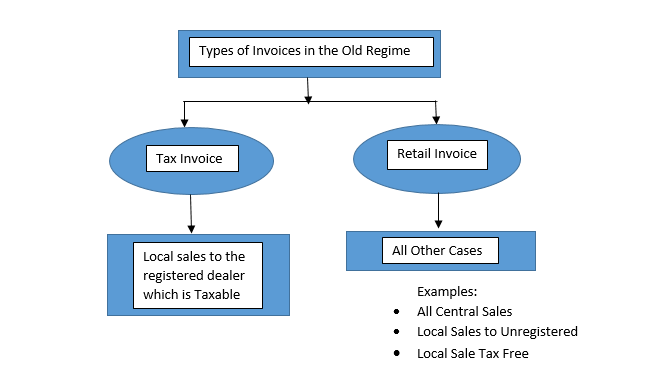

In the old regime there were only two types of invoices to be issued such as Tax Invoice and Retail Invoice.

But there are different types of Invoices under GST for supply of Goods and Services. Let’s understand these different types of Invoices in this new era of GST.

Tax Invoice

Under GST, any registered person supplying goods or services is required to issue Tax invoices to its buyer. This document or invoice that is issued by the supplier to the buyer is known as “Invoice” or “Tax Invoice”.

In case of supply of services, the invoice is to be issued within 30 days from the date of supply. For small dealers, if the amount of invoice is less than Rs 200, then no invoice is to be issued.

If the amount of invoice exceeds Rs. 200 then it is mandatory to prepare ‘Tax invoice’.

The recipient of goods and services can take the benefit of Input Tax Credit on the basis of this Tax Invoice.

Input Tax Credit means to utilize credit of tax paid on purchases of goods or services against the tax liability which is to be paid.

Bill of Supply

There is a new concept in the GST regime of Bill of Supply. A person who has opted for composition scheme or who is supplying exempted goods or services or both is required to issue bill of supply. The recipient cannot claim input tax credit on the basis of Bill of Supply.

If registered person is supplying goods or services of less than Rs.200, it is optional to issue bill of supply. He may choose not to issue bill of supply for these small bills.

Receipt Voucher

When registered person receives any advance from the buyer, he needs to issue receipt voucher evidencing receipt of such payment.

Refund Voucher

Suppose if the receipt voucher has been issued to the buyer but against which no supply has been made, then the registered person is required to issue the Refund Voucher.

Payment voucher

When a person who is registered under GST, receives any supplies of goods or services from the unregistered person, he needs to issue payment voucher to the supplier at the time of making the payment under reverse charge.

Also a payment voucher is been issued on those transactions on which reverse charge is applicable.

Credit Note

Credit note should be issued by a seller to the buyer in case of goods returned or reduction in value of goods/supplies or both or in case of discount claims. The details of credit note should be declared in the tax return to reduce tax liability. The time limit to issue credit note is by September following the end of the financial year or the date of filing annual return whichever is earlier.

Debit Note

If seller finds that he charged less than the actual value of goods or services or both in the invoice, he can issue debit note to the buyer. Seller is required to declare the value of debit note in the GST return of the month during such debit note has been issued.

The Manner of issue of Invoices under GST

Invoices should be issued and maintained in the following manner:

In case of Goods:

- Original to the Recipient

- Duplicate to Transporter

- Triplicate to the Supplier (for his record)

In case of Supply:

- Original to the Recipient

- Duplicate to the Supplier (for his record)

Comments