After successful creation of JSON file from gstplus.com you can go through below steps to submit and file your GSTR-2 return on gst.gov.in portal : -

Step 1. Login and Navigate to GSTR-2 page and upload JSON file of GSTR-2.

1.1. Access the www.gst.gov.in URL. The GST Home page is displayed.

1.2. Login to the GST Portal with valid credentials.

1.3. Click the Services > Returns > Returns Dashboard command.

Alternatively, you can also click the Returns Dashboard link on the Dashboard.

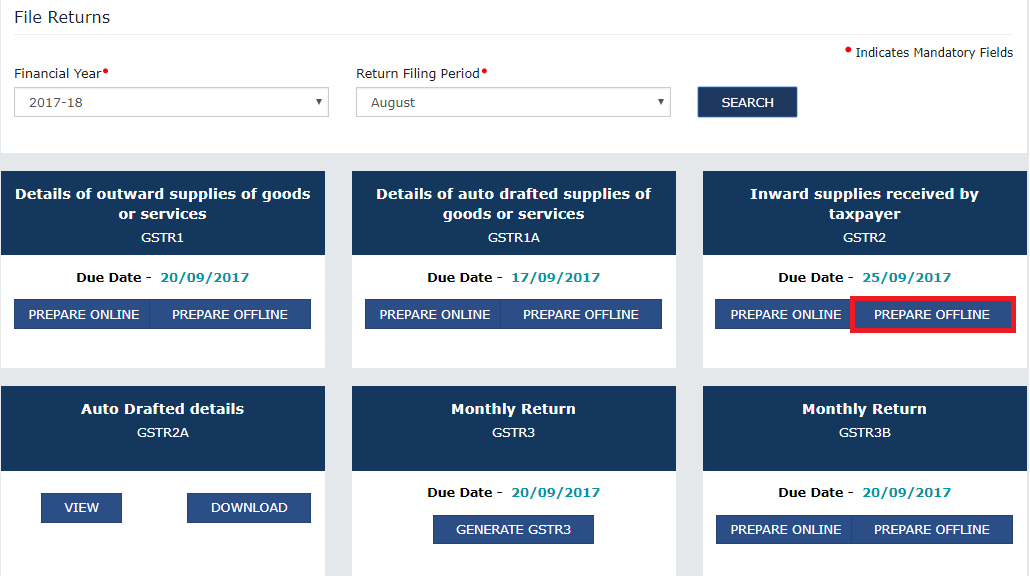

1.4. The File Returns page is displayed. Select the Financial Year & Return Filing Period (Month) for which you want to file the return from the drop-down list.

1.5. Click the SEARCH button.

1.6. The File Returns page is displayed. This page displays the various GSTR along with the due date of filing the returns, which the taxpayer is required to file as separate tiles.

In the GSTR-2 tile, click the PREPARE OFFLINE button to upload the JSON (Java Script Object Notation) file containing invoice details and other GSTR-2 details.

1.7. Upload the JSON File in the upload option displayed.

1.7(a) Click on Choose File button to upload JSON file.

1.7(b) Select the JSON file and click on OPEN button to upload the JSON file.

Once uploading gives Processed status follow step 1.3 to 1.5 again and select PREPARE ONLINE option in the GSTR-2 tiles displayed.

STEP 2. Preview GSTR-2

Once you have generated the GSTR-2 Summary, click the PREVIEW button. This button will download the draft Summary page of your GSTR-2 for your review. It is recommended that you download this Summary page and review the summary of entries made in different sections with patience before submitting the GSTR-2. The PDF file generated would bear watermark of draft as the details are yet to be submitted.

Note: The submit button will freeze the invoices uploaded in the GSTR-2 for that particular month.

STEP 3. Acknowledge and Submit GSTR-2 to freeze data

3.1. Select the Declaration check box.

3.2. In the Authorised Signatory drop-down list, select the authorized signatory. This will enable the two buttons - FILE GSTR-2 WITH DSC or FILE GSTR-2 WITH EVC.

3.3. Click the FILE GSTR-2 WITH DSC or FILE GSTR-2 WITH EVC button to file GSTR-2.

Note: On filing of the GSTR-2, notification through e-mail and SMS is sent to the Authorized Signatory.

3(a) FILE WITH DSC:

i. Click the PROCEED button.

ii. Select the certificate and click the SIGN button.

3(b) FILE WITH EVC:

i. Enter the OTP sent on email and mobile number of the Authorized Signatory registered at the GST Portal and click the VERIFY button.

3.4. The success message is displayed. Refresh the page.

The status of GSTR-2 changes to Filed.

Note: On filing of the GSTR-2, notification through e-mail and SMS is sent to the Authorized Signatory.

3.5. Scroll down the page and click the Back button.

Once GSTR-2 is submitted you can go through below steps to View GSTR-2 Status : -

- The File Returns page is displayed. Select the Financial Year & Return Filing Period (Month) for which you want to view the return from the drop-down list.

- Click the SEARCH button.

Status of the GSTR-2 return changes to "Filed".

Comments