In GST, the journey of filing the return starts from FORM GSTR-1. It has the details of all outward supplies made by the suppliers.This transaction-wise, destination-based reporting system provides for a much effective credit flow, removes chances of corruption and illegal transactions. To achieve this, the government has come up with an effective form-based reporting system that needs to be filed either monthly, quarterly or yearly, as the case may be, by the dealers and manufacturers.

This handy guide will take you through each minute details which a taxpayer should know about GSTR-1 and GSTR-1A under GST.

What is GSTR-1?

GSTR 1 is a monthly return which records the details of all outward supplies made during the month. However, it is compulsory to file it even if there were no transactions during the relevant period.

Accordingly, in the 23rd GST Council Meeting held on 10th November 2017, taxpayers with annual aggregate turnover upto Rs. 1.5 crores need to file GSTR-1 on quarterly basis.

|

Sr.No. |

Quarter for which the details in Form GSTR-1 are furnished |

Time period for furnishing the details in Form GSTR-1 |

|

1. |

July - September, 2017 |

31st December, 2017 |

|

2. |

October - December, 2017 |

15th February, 2018 |

|

3. |

January - March, 2018 |

30thApril, 2018 |

The return for the taxpayers whose turnover is more than Rs 1.5 crores have to file a monthly return. The due dates for such taxpayers is as follows:

|

Sr. No |

Months for which the details in Form GSTR-1 are furnished |

Time period for furnishing the details in Form GSTR-1 |

|

1. |

From July-October, 2017 |

31st December, 2017 |

|

2. |

November, 2017 |

10th January, 2018 |

|

3. |

December, 2017 |

10th February, 2018 |

|

4. |

January, 2018 |

10th March, 2018 |

|

5. |

February, 2018 |

10th April, 2018 |

|

6. |

March, 2018 |

10th May, 2018 |

Who needs to file GSTR-1?

Every registered person under GST needs to file GSTR-1 before due date. Late filing would be acceptable only on payment of late fees.

Are there any exemption from filing of GSTR-1?

The following persons do not need to file GSTR 1 as there are separate returns specifically for them.

- Composition Dealers (GSTR-4)

- Input Service Distributors (GSTR-6)

- Non-Resident Taxable Person (GSTR-5)

- Persons liable to collect/deduct tax at source (TDS/TCS) (GSTR-7)

- E-commerce Operators (GSTR-8)

What is Form GSTR-1 and how to file it of GST website?

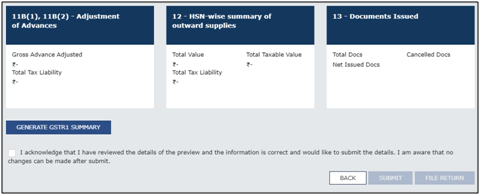

Form GSTR-1 contains 13 tables in which the outward supplies details needs to be captured. Based on the nature of business and the nature of supplies effected during the month, only the relevant tables are applicable, not all. The GSTR-1 format is as follows:

- Enter the details of GSTIN and aggregate turnover in preceding year.

- Block 1: Taxable outward supplies made to registered persons (including UIN-holders)

- Block 2: Taxable outward inter-State supplies to un-registered persons where the invoice value is more than Rs 2.5 Lakh.

- Block 3: Details of credit and debit note issued to registered person.

- Block 4: Details of credit and debit notes issued to unregistered person.

- Block 5: Details of exports made during the relevant tax period.

- Block 6:Details of Taxable supplies (Net of debit notes and credit notes) to unregistered persons other than the supplies covered in Block 2.

- Block 7: Details of Nil rated, exempted and non GST outward supplies.

- Block 8 and 9: Details of Advances Received/Advance adjusted in the current tax period or Amendments of information furnished in earlier tax period.

- Block 10: HSN-wise summary of outward supplies.

- Block 11: Documents issued during the tax period.

How can I Revise GSTR-1?

Till now it is not possible to revise GSTR-1 return. If there is any rectification or revision, you can do it while filing next month’s return.

What if I don’t file GSTR-1?

It is important to file your GSTR 1 on time to avoid penalties and default notices. There is a penalty of Rs. 50 per day (Rs 25 for CGST and Rs 25 for SGST) for late filing of returns. In case of NIL return, penalty is Rs. 20 per day (Rs 10 for CGST and Rs 10 for SGST)

Conclusion:

If you want to avoid multiple steps and hassle, try our software “GSTplus” today. It is easy to use accounting software with fast GST return filing. It is designed for business owners who do not have any accounting background.

In case you are confused about GST as a business owner or representative, feel free to consult the GST experts at Skorydov Systems Private Limited on gstplus@skorydov.com.

Comments