In GST, the journey of filing the return starts from FORM GSTR-1. It has the details of all outward supplies made by the suppliers. Similarly, all the details of inward supplies of goods and services received during a month have to be filed in FORM GSTR-2. In this article we shall study in detail about GSTR-2. It is important to understand and digest the importance of GSTR-2.

What is GSTR-2?

Once the supplier has filled up the details of sales made during a tax month in FORM GSTR-1, it is now the task of recipients to file their receipts of goods or services in FORM GSTR-2.

What are the contents of GSTR-2?

GSTR-2 contains all the details of inward supplies that is all the purchases of registered dealer made during a month. It also contains the details of purchases on which reverse charge is applicable. Based on this return, the Input Tax Credit that a taxpayer is eligible to claim is determined.

Who needs to file GSTR-2?

Form GSTR-2 is to be filed by all the dealers who are registered under the GST Act. Those who have filed GSTR-1 are mandatorily required to file GSTR-2.

Only Input service distributors, dealers registered under the composition scheme and E-commerce operators are not required to file GSTR-2.

What is the due date to file GSTR-2 and the process to file it?

The due date to file GSTR-2 is 15th of next month that is Five days after filing of GSTR-1.

The process to file GSTR-2 is quiet complex. Let’s understand this process step-by-step:

Step 1: After your suppliers have filed GSTR-1, the details of your inward supplies get auto-populated in Form GSTR-2A. All the transactions seen in this form are considered as purchases for you.

Step 2: The Form GSTR-2A can only be viewed and no modifications can be made to this. All the modifications and omissions which is required in Form GSTR-2A can be made in Form GSTR-2.

Step 3: In Form GSTR-2, you need to import all the data of GSTR-2A and also enter the omitted data (if any). For example, the details of purchases from unregistered dealers and purchases not reflecting in GSTR-2A.

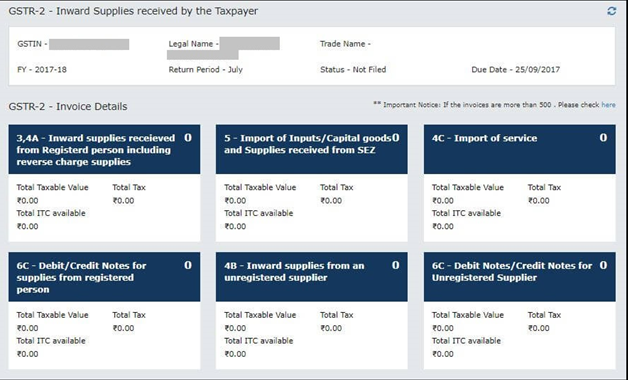

Step 4: In Form GSTR-2, we can see 11 requirements to be furnished. Here is the screen of how Form GSTR-2 looks like:

What needs to be filed in GSTR-2?

Let’s have a look at the contents of the form. This is a much-detailed form when compared to GSTR-1.

- Basic Details:

- Name and address of the dealer – this field shall be auto-populated after logging in to the GSTN portal.

- 15-digit GSTIN of the dealer – this field shall be auto-populated after logging in to the GSTN portal.

- The return filing period – the month and the year for which the return is being filed.

- Inward supplies received from registered person including reverse charge supplies:

- Details of all the incoming materials and services received by the dealer are auto-populated with the details of GSTR-1. This is a key part of the form that displays the purchases of the dealer made during the tax month. There can be differences in the list of invoices, which can be corrected by the dealer filing the return. Such dealer can fill in the extra or additional details manually. The corresponding supplier will have a notification to that effect, and the same will be reflected in GSTR-1A, which the supplier has to accept accordingly.

- Import of Inputs/Capital Goods and supplies received from SEZ:

- Imports of inputs or Capital Goods and supplies received from SEZ are considered as an inter-state movement of goods, accordingly IGST will be charged in this case.

- Import of Service:

- Details of services received from persons resident outside India relates to import of services. These Imported services will fall under Reverse Charge Mechanism of GST and accordingly such details will come under Inward Supplies on which tax is to be charged on Reverse Charge.

- Debit notes and credit notes details:

- All debit and credit notes must be reported by a taxable person. Debit notes and credit notes issued under reverse charge mechanism, if any, will be auto-populated from GSTR-1 and GSTR-5 (Form for Non-Resident Foreign Taxpayers) of counter-party.

- Any amendment in debit and credit note pertaining to previous months shall be reported under this heading. This will mainly include the changes made under reverse charge mechanism transactions. Any other modification will be auto-populated.

- Inward Supplies from an Unregistered Supplier:

- This is a common field for mentioning all kinds of supplies that have been received from unregistered persons, both intra-state and inter-state. The supplies that are received shall include materials received from an unregistered person, composition dealer and remaining non-GST, exempted or zero-rated supplies.

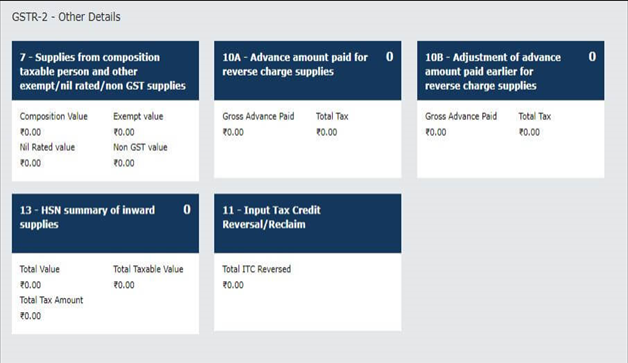

- Input Tax Credit (ITC) Reversal

- All kind of input tax reversal are reported here along with the reason for reversal including, ITC reversal owing to exempt and non-business supplies.

ITC is not allowed on few services. For example, goods and/or services used for private or personal consumption, to the extent they are so consumed.

- HSN Summary of Inward Supplies

- Here you need to give HSN wise summary of Inward Supplies made during the month.

Conclusion:

GSTR 2 is the comprehensive return where detailed information has to be furnished. Proper invoicing and documentation would be key feature to furnish the correct information in such return.

In case you are confused about GST as a business owner or representative, feel free to consult the GST experts at Skorydov Systems Private Limited on gstplus@skorydov.com.

You can get comprehensive assistance on GST Registration and GST Return Filing. You can also use our GST software “GSTplus” for doing end-to-end GST compliance.

Comments