Tax Payments under GST

Every person registered under GST has to file the returns and pay the Tax liability by using Input Tax Credit (ITC) against the outward liability. After this, if any tax liability remains, it is required to be paid to the government. In this article we will learn about the payment of Tax under GST.

Who is liable to pay GST?

In general, the supplier of goods and services is liable to pay GST. However in specified cases like imports and other notified supplies, the liability may be on the recipient under the reverse charge mechanism.

Further, in some cases, the liability to pay is on the third person (say in the case of e-commerce operator responsible for TCS or Government Department responsible for TDS).

What are the payments to be made under GST?

If there are any Intra-state supplies of Goods and services, then the tax to be paid is CGST (GST going into the account of Central Government) and SGST (GST going into the account of concerned State Government).

If there are any Inter-state supplies of Goods and services, then the tax to be paid is IGST (Integrated GST).

In some supplies, Cess is also levied.

In addition, certain categories of registered persons will be required to pay Tax Deducted at Source (TDS) and Tax Collected at Source (TCS). Also, wherever applicable, Interest, Penalty, Fees and any other payment will also be levied.

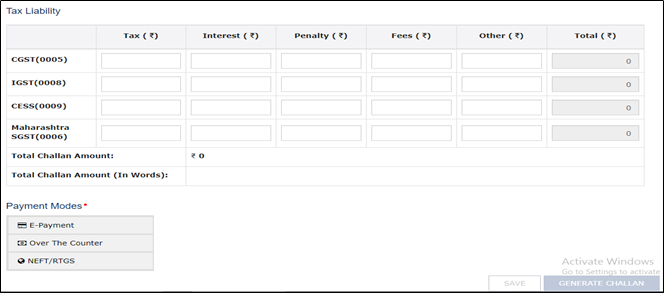

How can the GST payment be done?

GST Payment can be done in any of the following ways:

1. Over the counter payment: Payment by this method can only be done if the tax liabilty is upto Rs. 10,000/-. The user is required to visit the bank with a print out of the challan created from the GST Portal.

2. NEFT/ RTGS

3. E-Payment

How to Create Challan?

Visit the portal www.gst.gov.in. Under the Tab “Services”—“Payments”---“Create Challan”.

Electronic Credit Ledger:

All the taxes paid by the taxpayer on the inputs would be recorded in the electronic credit ledger. Electronic credit ledger would be auto-populated based on the GSTR-1 and GSTR-2 returns filed by all taxpayers registered under GST.

The credit in the electronic ledger can be used to offset GST liability in the following manner:

IGST Credit

After the IGST input tax credit is used for payment of IGST, the remaining input tax credit can be used to pay tax liability under CGST and at last SGST.

CGST Credit

The input tax credit of CGST can be used to pay IGST liability. However, CGST credit cannot be used to set-off the SGST liability.

SGST Credit

SGST input tax credit cannot be used to pay the CGST liability but can be used to pay the liability under IGST.

All the payments under GST have to be made by either using the input tax credit available in the electronic credit ledger or through the electronic cash ledger. A unique identification number shall be generated in GST Common Portal for each debit or credit to the electronic cash or credit ledger.

Is there a validity period of Tax Challan which is seen as above?

Yes, a challan will be valid for fifteen days after its generation and thereafter it will be purged from the System. However, the taxpayer can generate another challan at his convenience.

What is CPIN?

CPIN stands for Common Portal Identification Number (CPIN) given at the time of generation of challan. It is a 14 digit unique number to identify the challan. As stated above, the CPIN remains valid for a period of 15 days.

When is payment of taxes to be made by the Supplier?

Payment of taxes by the normal taxpayer is to be done on a monthly basis by the 20th of the succeeding month. Composition tax payers will need to pay tax on quarterly basis. Example: For a normal tax payer, payment of taxes for the month of March shall be made by the 20th of April. For a composition dealer, payment of taxes for the quarter January - March shall be made by the 20th of April.

In case you are confused about GST as a business owner or representative, please feel free to consult GST experts on gstplus@skorydov.com. You can also use our software “GSTplus” for end-to-end GST compliance.

Comments