Guide on Filing GSTR-3B

Let us understand GSTR-3B in detail.

What is GSTR-3B?

GSTR-3B is a monthly return by declaring the summary of all inward and outward supplies made during the tax period. The due date for filing this monthly return is 20th of next month.

For example: The return for the month of October 2017 is to be filed by 20th of November, 2017.

Who needs to file GSTR-3B?

Every registered tax payer needs to file a separate GSTR-3B for each GSTIN they have. Even if there are no transactions during the month, registered businesses still need to file NIL GSTR-3B.

This is more like a self-declaration return and the tax payer is not required to provide invoice level information in this form. Only total values for each field have to be provided.

Who are exempted from filing GSTR-3B?

Following categories of registered person are exempted from filing GSTR-3B:

- Input Service Distributors

- Business registered under GST Composition scheme

- Suppliers of online information and database access or retrieval services (OIDAR), who have to pay tax themselves.

- Non-resident taxable person

- TDS and TCS Deductor

Important points for filing GSTR-3B?

- GSTR 3B to be filed mandatorily by all normally registered taxpayers. It needs to be separately filed for each GST registration number

- Nil returns to be filed in case of no business transactions. Recently, GSTN portal offers the simple and fast procedure to file GSTR 3B return. In the latest offering, the taxpayers who are filing nil returns are free from extensive filing details and will be forwarded to simple return form with minimum details. No extra tiles and details are required from this new functionality.

- Summary of information about sale and purchase, available input tax credit, tax payable, tax paid is to be furnished.

- All input tax credit availed and utilized will be posted in the ITC ledger.

- Unutilized ITC can be used in subsequent months

- While filling up form GSTR 3B, don’t forget to Save partially filled form by clicking save GSTR 3B button

- After pressing submit, no modification is possible therefore check the details carefully before pressing submit

- If there is any tax payable then payment of such tax is mandatory for filing of form GSTR-3B. In other words, GSTR-3B return cannot be filed without full payment of the tax due.

Below is the step wise guide on How to submit GSTR-3B on GST Portal.

Step 1: Login in to www.gst.gov.in using valid credentials. Go to Return Dashboard---Select the Tax period for which GSTR-3B is to be filed---and then click on"Prepare Online" under GSTR-3B tile.

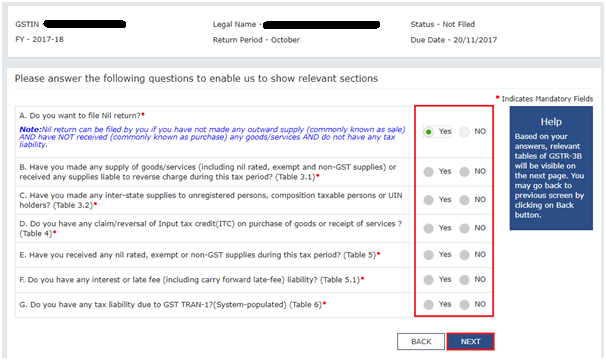

Step 2: After selecting GSTR-3B the following screen appears.

Answer the questions as applicable to you. Then click on "Next". If you want to file NIL Return, select Yes in the first question.

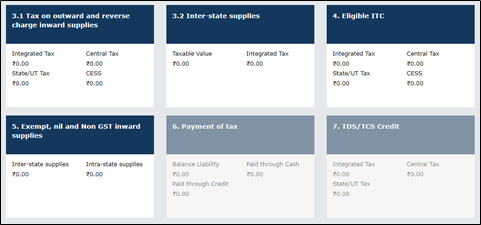

Step 3: Based on your answers in the previous steps, the following screen will appear.

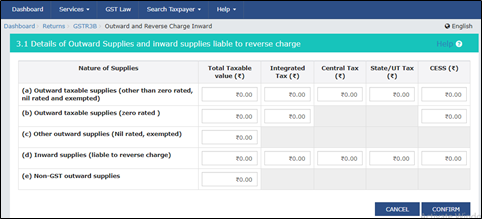

Step 4: This tile includes the details to be furnished of outward and inward supplies including supplies to which reverse charge is applicable. Following details are to be furnished:

Outward taxable supplies (other than zero-rated, nil rated and exempted)

- In this row, fill out all the items other than export, nil rated and exempted goods which are sold by the business on regular basis. In the respective tax column enter the total of IGST, CGST, SGST and Cess.

- Outward taxable supplies (zero-rated)

In this row, only zero rate tax items that is exports will be included. In the tax column only the total of IGST will appear. - Other outward supplies (Nil rated and exempted)

In this row, only the details of Nil rated that is 0% GST rate and exempted goods will appear. As there is no Tax applicable on such Goods, the tax section is deactivated. - Inward Supplies liable to (Reverse charge)

Details of total supplies which attract reverse charge is to be mentioned here. - Non GST outward supplies

Includes all the Non-GST outward supplies which are not covered by the GST tax scheme.

Once the above details are furnished, please click on confirm and proceed further.

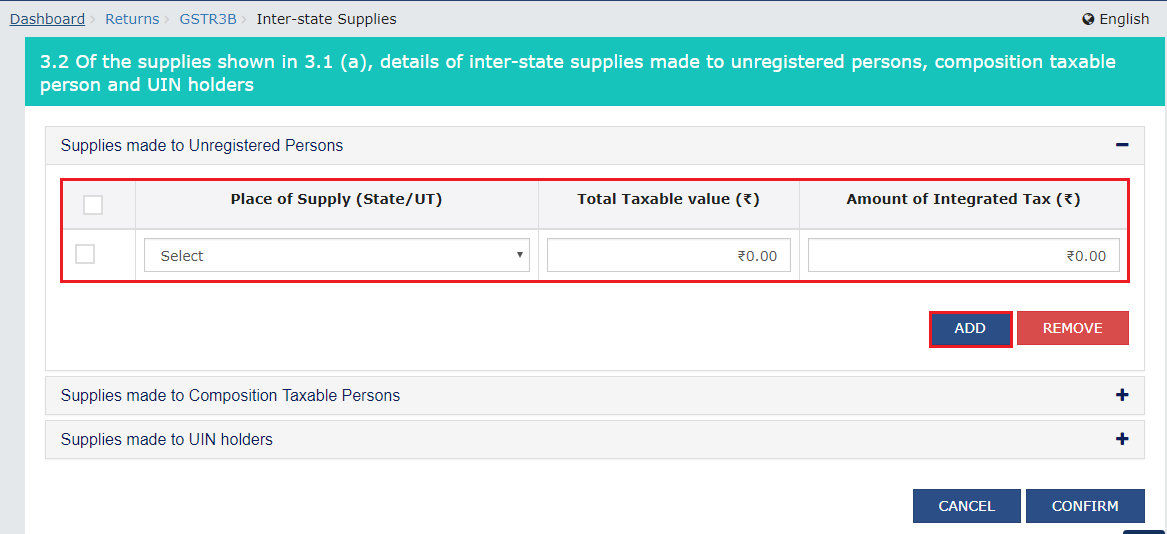

Step 5: Following screen will appear. Fill the details as applicable to you.

Once the above details are filled, click on confirm button.

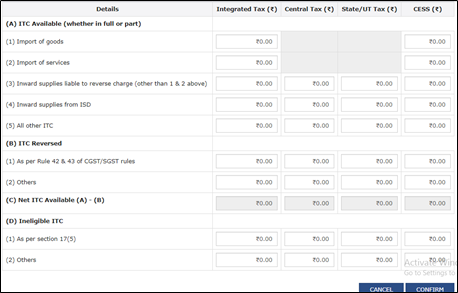

Step 6: Once the above details are saved, click on Eligible ITC. Enter the details of all the input tax credit.

(A) What details are required to be entered here?

Here, details of all Input Taxes are required to be entered.

(B) What details are to be filled in “ITC Reversed”?

The Input Tax Credit on account of supplies or purchase of Capital Goods made for partly personal purposes, partly for exempt/ nil rated supplies should be reversed in “ITC Reversed”.

(C) What details are to be filled in “Ineligible ITC”?

Here, details of Ineligible ITC such as Input Tax Credit on Membership of a Club are to be entered.

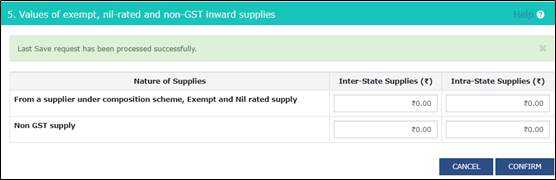

Step 7: Here, details are to be provided on the basis of Nature of Supply. This detail is separately for Inter-state supply & Intra-state supplies. Supply from a supplier under composition scheme, Exempt & Nil rated supply is to be shown in totality. Non-GST supply is to be entered separately.

Step 8:Interest & Late Fee

Here, the above shown checkbox needs to be ticked to be able to enter details of interest. Interest leviable on late payment of IGST/ CGST/ SGST/ UGST & Cess needs to be entered here.

Step 9:After filling all the details accurately, click on "Preview & Submit".

Step 10:If any changes are to be done, you can reset the data by clicking "Reset GSTR 3B" and fill the details again.

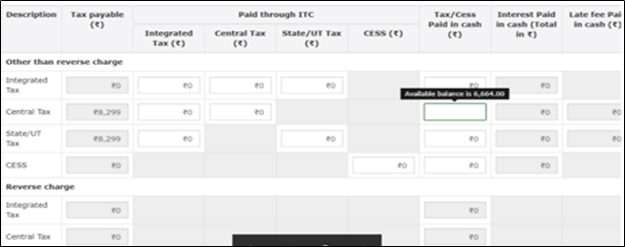

Step 11: Now comes the important tile which is for the payment of taxes, which includes a number of significant data which has to be filled up with accurate details:

- Integrated Tax

- Central Tax

- State/UT Tax Cess

Once the details are filled, you need to offset the liability to utilize the credit available.

Step 12: Once Payment of all liability is made and the same is offsetted, your return is ready to be filed. The return can be filed with DSC and EVC as applicable to you. Once you have filed GSTR-3B, you will get a success message & acknowledgement number will be displayed. Also a message will be sent to the Email ID of the Authorised Signatory containing ARN and confirmation of the return filed.

Thus the above steps are to be followed to fill the Form GSTR-3B accurately.

Comments