Below is a step wise guide on how to submit GSTR-1 using GSTplus.com

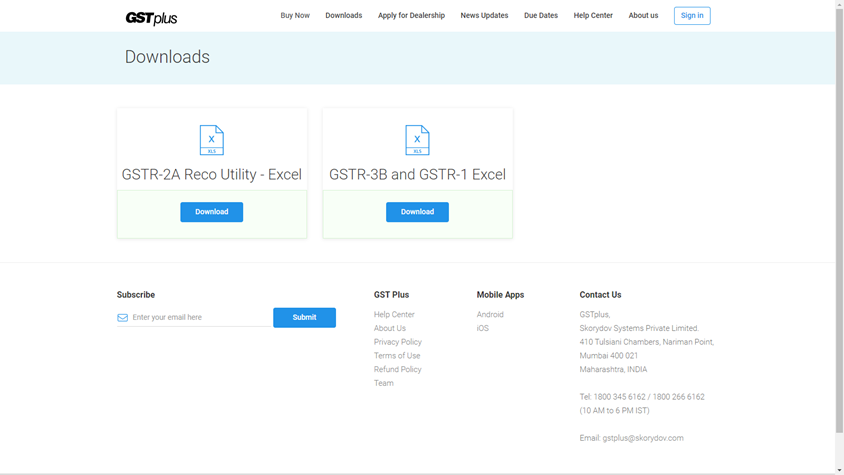

Step 1- Visit https://GSTplus.com/downloads and click on ‘Download’ button of ‘GSTR-3B and GSTR-1 Excel’.

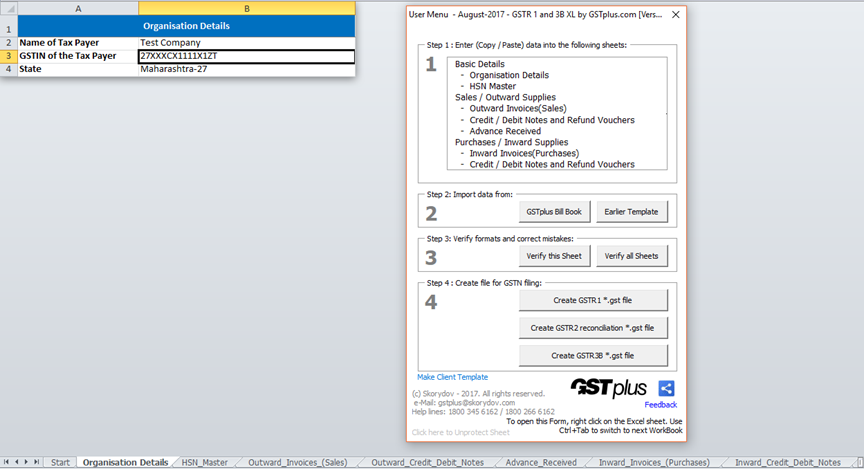

Step 2- Extract the excel template and enter the details. When you click on 'Verify this sheet / Verify all Sheets", errors if any, will be displayed. Correct the errors. Now click on ‘Create GSTR-1 *.gst file’ to export data for GSTR-1.

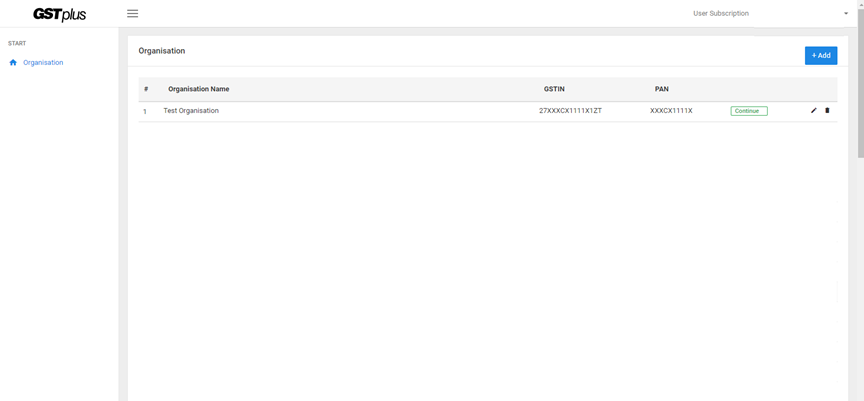

Step 3 - Now logon to GSTplus.com (Log-in) or Sign-Up if not already. Click on ‘+Add’ button to add your Organisation or click on ‘Continue’ if already added.

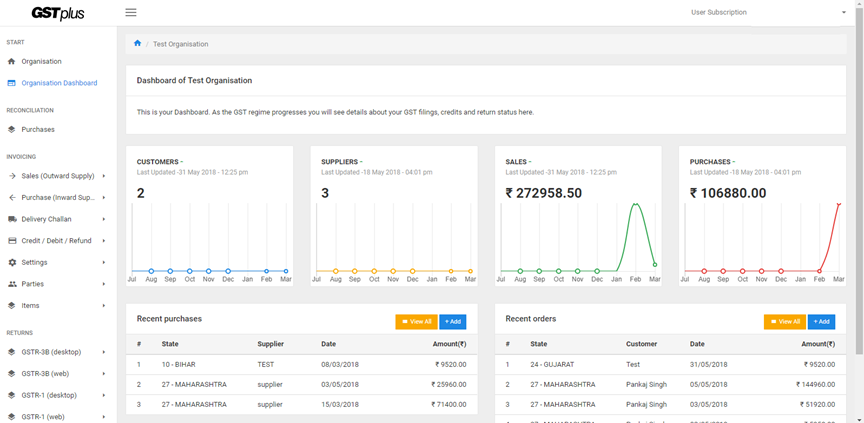

Step-4- On the Left Menu, click on ‘GSTR-1’ >> ‘Import GSTR-1’

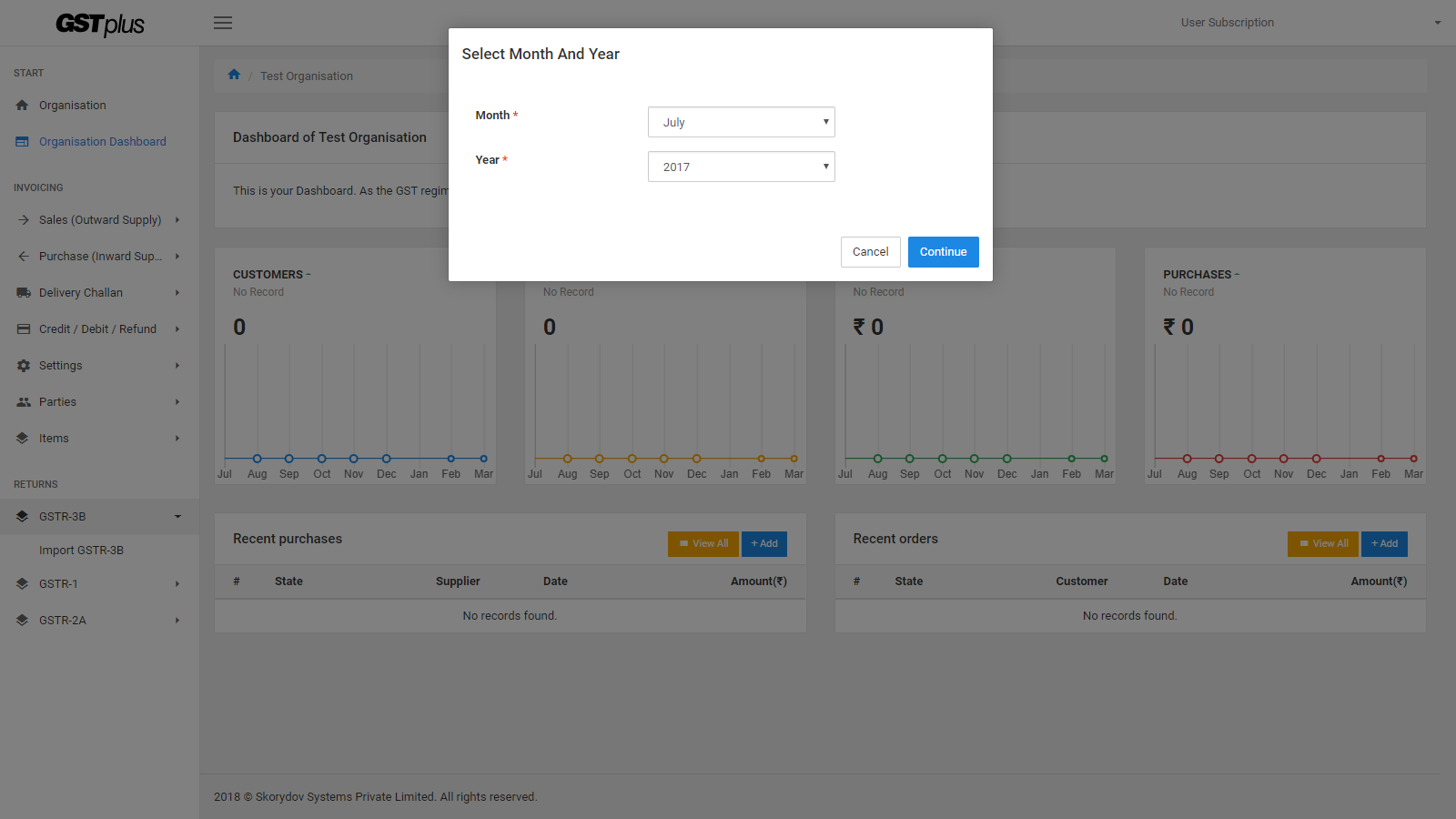

Step 5 -Select Return period (Month and Year) to continue

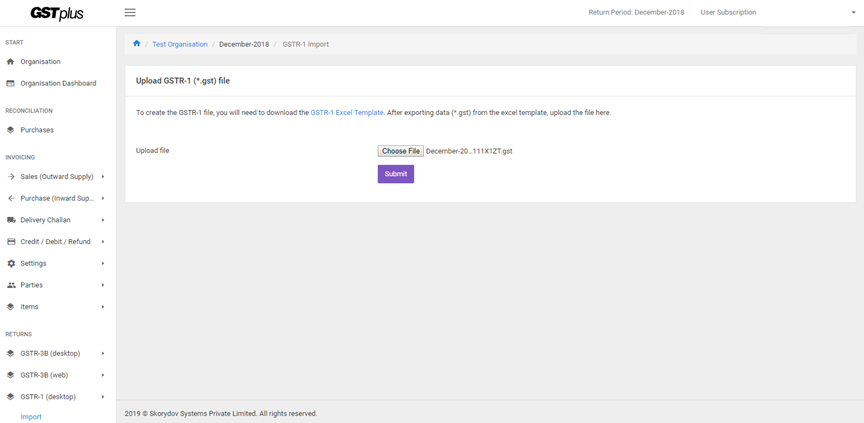

Step 6 -Choose the *.GST file created earlier and click on ‘Submit’.

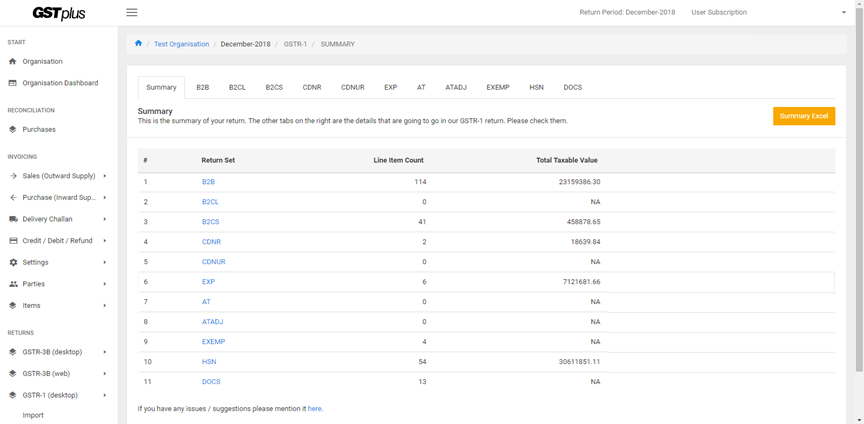

Step 7 -Now you shall be able to see the summary of your return. The other tabs on the right are the details that are going to go in our GSTR-1 return.

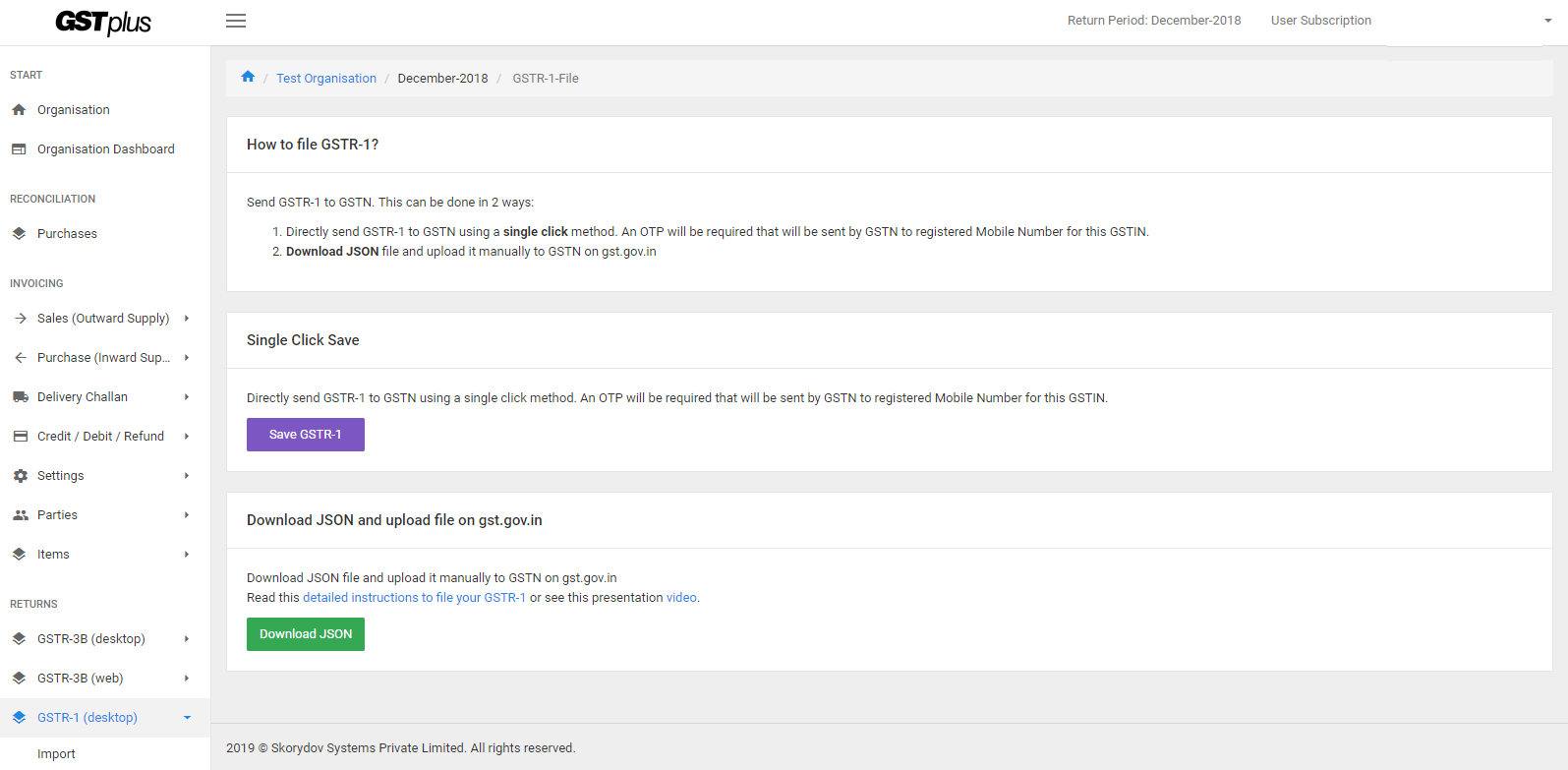

Step 8 -GSTR-1 details will be shown as below. You have multiple options to proceed from here.

(a) You can download Json file (from Left Menu option, GSTR-1>> Send to GSTN >> Download Json) and upload the same on gst.gov.in portal as offline method there under GSTR-1.

(b) You can SAVE the records directly on gst.gov.in portal using api (from Left Menu option, GSTR-1>> Send to GSTN >> Save to GSTN).

Note-: Waiver of a late fee to be given to all taxpayers in respect of all pending FORM GSTR-1from July 2017 to November 2019, if the same are filed by 10.01.2020.

E-way bill for taxpayers who have not filed their FORM GSTR-1 for two tax periods shall be blocked.

If you wish to file GSTR-1 directly from gst.gov.in portal, read this guide on GSTR-1.

Comments